Retirement Planning For Children - Harnessing the Power of Time

A few years ago a friend of mine sent me the following quote from Albert Allen Bartlett, an emeritus professor of physics at the University of Colorado, Boulder.

"The greatest shortcoming of the human race is our inability to understand the exponential function."

Bartlett was specifically referring to the population growth of the human race, but the statement is applicable and true in the world of investing and behavioral finance. The exponential function is a powerful tool when grasped, harnessed, and properly applied… so let’s apply it in a truly meaningful way that will change lives for the better!

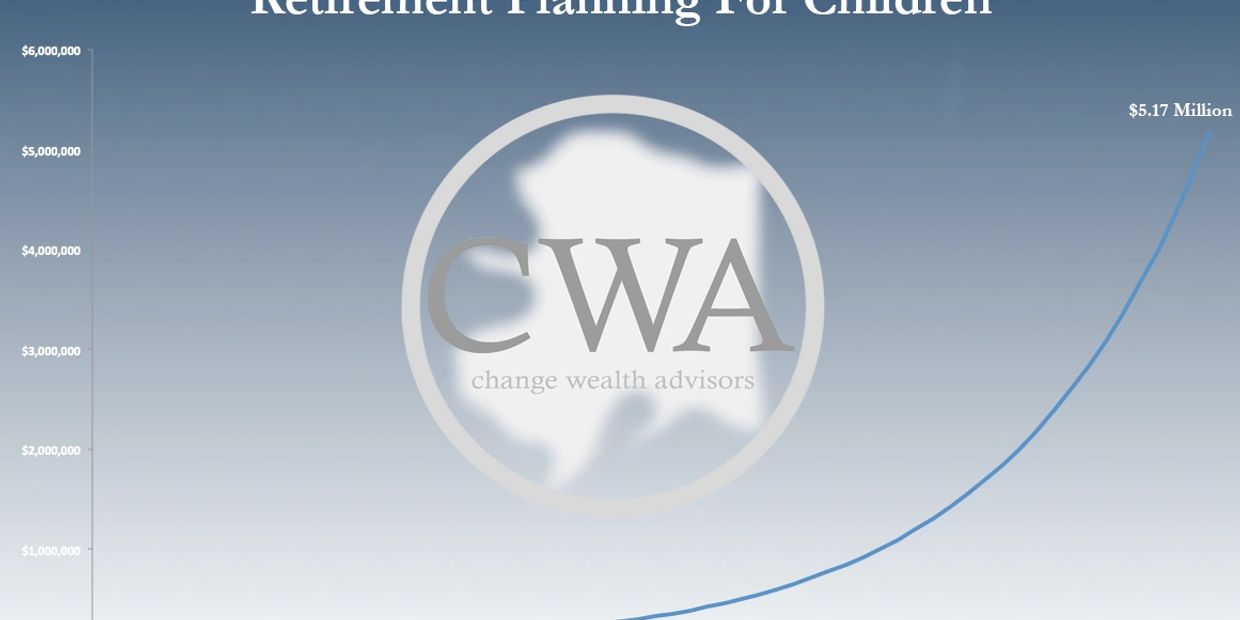

“Retirement Planning For Children” is a new way of applying old math. No matter what numbers are plugged into a graph that illustrates the potential future value of an investment, the shape of the graph looks the same as the chart above. The slope is gradual and then takes off in dramatic fashion, but not until about year 30. If someone achieves a given rate of return over an extended period of time, the impact in terms of real dollars becomes quite substantial. There are three factors that go into these charts: time, investment, and rate of return. Of these three factors, the most important factor is time.

We all hear about college planning for children, which is highly important, but have you ever heard about retirement planning for children? The chart above is the visual display of the answer to a curiosity project that asked the following question: “What is needed to secure a child’s financial future?” As it turns out, the financial investment is very low, and the rate of return needed is quite reasonable as long as you provide enough time.

What we found is that if $2000 a year is invested on behalf of a child for the first 18 years of their life, after that no additional funds are added, and those funds grow untouched at a rate of 9%, then that child will have a retirement fund of $5.19 million at the age of 65.

This of course does not take into account the impact of fees, taxes, or transaction costs, and inflation will undeniably impact the purchasing power of $5.19 million in 65 years. That said, 9% is less than the historical long-term average return of the S&P 500. It’s impossible to predict the future or know what it holds, but history gives us a good reference point (because it’s the only reference point) to help us understand short-term and long-term market behavior.

What this information ultimately supports is the importance of time relative to the power of the exponential function. In very simple and meaningful terms, for as little as $2000 a year for 18 years, the potential to secure the financial future of a child is attainable.

We often overlook the financial future of our children, grandchildren, nieces, and nephews because they presumably have more time than us. What if we focused on the most powerful advantage they have and harnessed it instead of dismissing it? If we did it would cost everyone substantially less and provide them with substantially more.

Albert Allen Bartlett

"The greatest shortcoming of the human race is our inability to understand the exponential function."

Advisory services offered through Change Wealth Advisors, LLC; an Alaska registered investment advisor.

Change Wealth Advisors, LLC does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

This site is published for residents of the United States only. Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. For additional information, please contact Adam Sikorski at 907-202-2105.